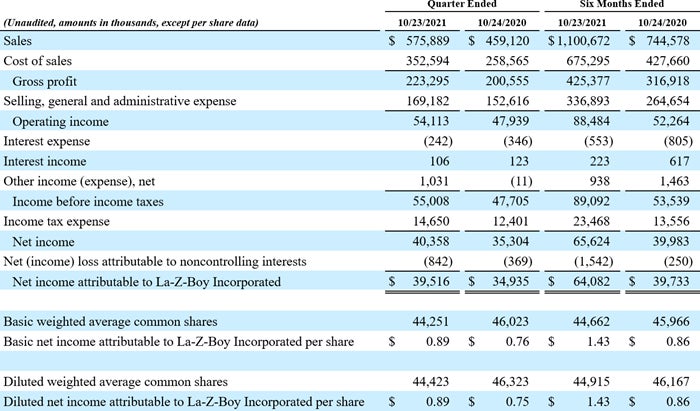

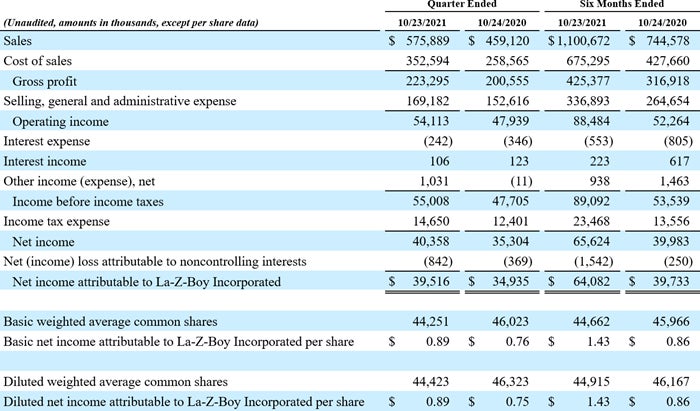

Consolidated Statement of Income

Monroe, MI (November 16, 2021) – La-Z-Boy Incorporated (NYSE: LZB), a global leader in residential furniture, today reported operating results for the fiscal 2022 second quarter ended October 23, 2021.

Melinda D. Whittington, President and Chief Executive Officer of La-Z-Boy, said, "La-Z-Boy Incorporated again delivered all-time, record-high sales for the quarter as we continued to increase capacity to service ongoing demand and our significant backlog, and realized pricing and surcharge actions to help offset rising raw material costs. Even while navigating a challenging operating environment with significant widespread supply chain disruption, we delivered strong results, including improved margins versus last quarter. Our business is much larger today than it was pre-pandemic, and demand remains robust across the entire enterprise. With strong brands and vast distribution through multiple channels, we believe our sales momentum is sustainable. As we execute Century Vision, our winning strategy for growth to our Centennial year in 2027, we are making strategic investments across our business to drive market share gains, profitable growth and excellent returns for all stakeholders."

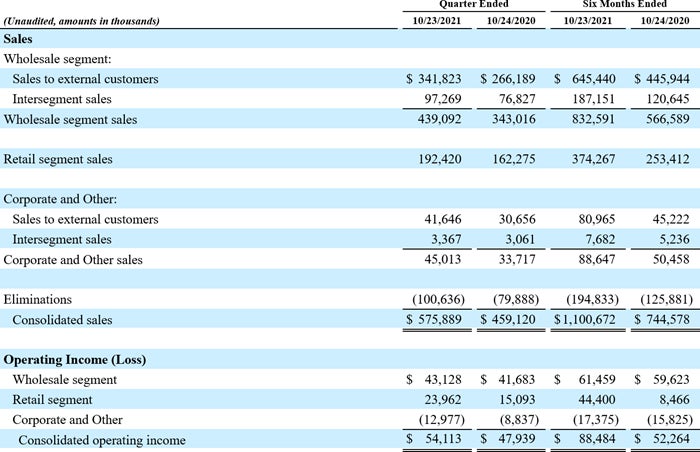

Consolidated sales in the second quarter of fiscal 2022 increased 25% to $576 million versus the fiscal 2021 second quarter, reflecting ongoing capacity increases and pricing and surcharge actions. Consolidated sales for the fiscal 2022 second quarter were 29% higher than the pre-pandemic fiscal 2020 second quarter, for a compounded annual growth rate of 14% over the last two years.

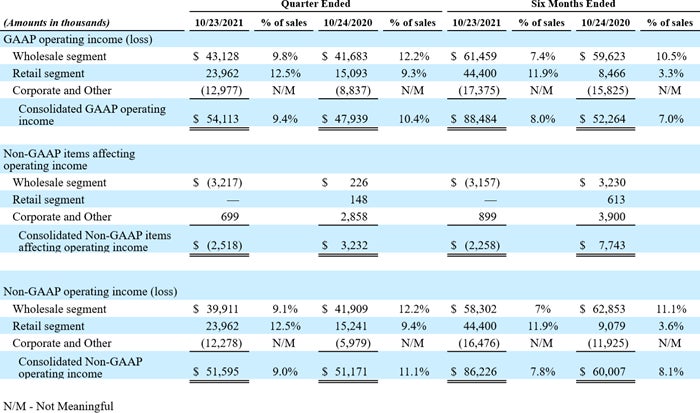

Consolidated GAAP operating margin was 9.4% versus 10.4% in the prior-year second quarter. Consolidated non-GAAP(1) operating margin was 9.0% versus 11.1% in the prior-year second quarter and improved sequentially from 6.6% in the fiscal 2022 first quarter. Operating margin for the period was primarily impacted by significant increases in commodity and freight costs, start-up costs associated with the expansion of manufacturing capacity and labor challenges in the company's Wholesale business, partially offset by pricing and surcharge actions and fixed-cost leverage on higher volume.

GAAP diluted EPS increased to $0.89 for the fiscal 2022 second quarter versus $0.75 in the prior-year quarter. Non-GAAP(1) diluted EPS increased to $0.85 versus $0.82 in the prior-year second quarter.

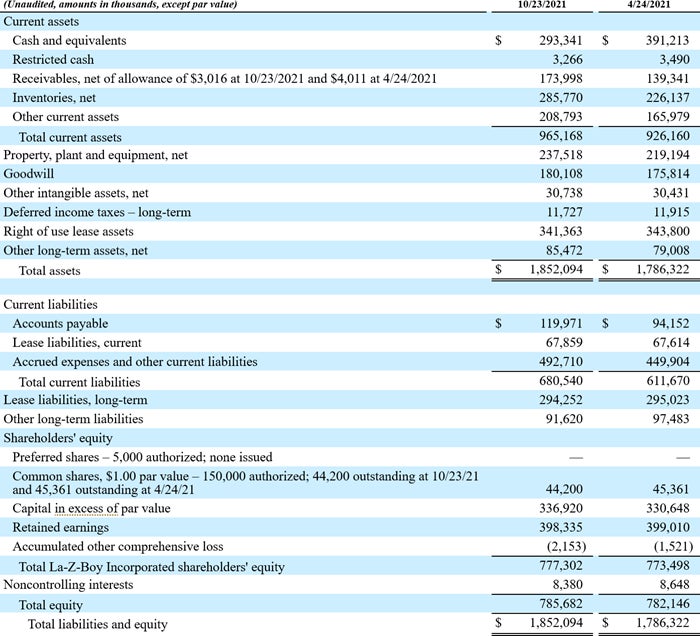

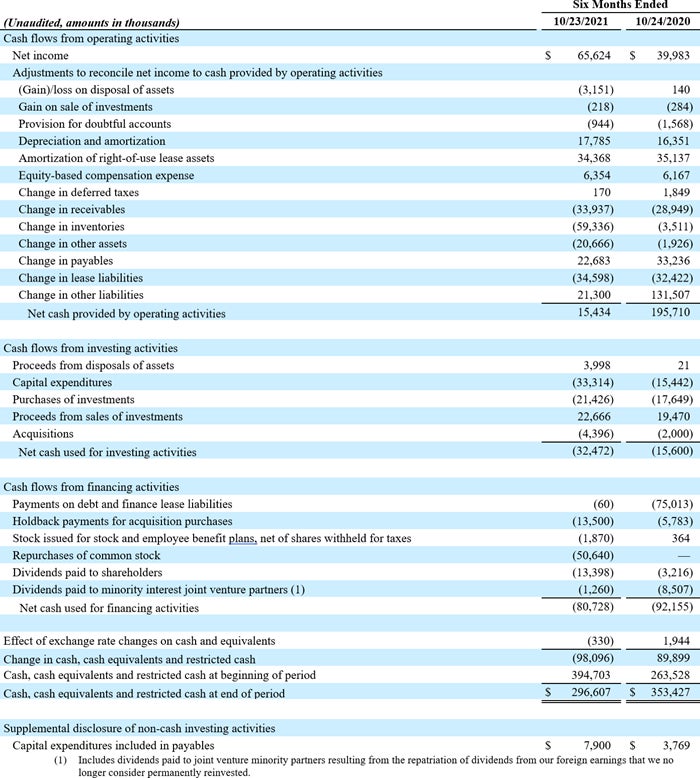

Fiscal 2022 year to date, the company generated $15 million in cash from operating activities, after investing $59 million in higher inventory levels to protect against supply chain disruptions and to support increased production and delivered sales.

Over the first half of fiscal 2022, the company continued to make disciplined investments in the business, including $33 million in capital expenditures to increase capacity, remodel stores, open new stores, and upgrade infrastructure. In addition, the company has continued to return capital to shareholders, including $13 million in dividends, with $6.6 million paid in the second quarter, as well as $51 million in share repurchases, or approximately 1.4 million shares of stock, leaving approximately 8.6 million shares available for repurchase under its authorized share repurchase program as of October 23, 2021.

La-Z-Boy ended the period with $297 million in cash(2) compared with $353 million in cash(2) at the end of the fiscal 2021 second quarter. The company holds $31 million in investments to enhance returns on cash versus $27 million at the end of the fiscal 2021 second quarter.

On November 16, 2021, the Board of Directors declared a quarterly cash dividend of $0.165 per share on the common stock of the company, an increase of 10% over the prior quarter. The dividend will be paid on December 15, 2021, to shareholders of record on December 2, 2021.

Bob Lucian, Chief Financial Officer of La-Z-Boy Incorporated, said, “Demand trends remain strong, our backlog is high and we expect delivered sales to continue to strengthen, particularly in the fourth quarter as new production cells come online. At the same time, we expect continued supply chain disruptions, including a temporary, but significant, slowdown in our casegoods business due to COVID-related shutdowns in Vietnam. Quarterly trends will also be impacted by our third and fourth quarters containing 12 and 14 production weeks, respectively, compared to 13 production weeks in our second quarter. Taking all of these factors into consideration, we continue to expect sales and margin momentum to accelerate, particularly in the fourth quarter, and we continue to expect to deliver full-year consolidated operating margin at or near double digits.”

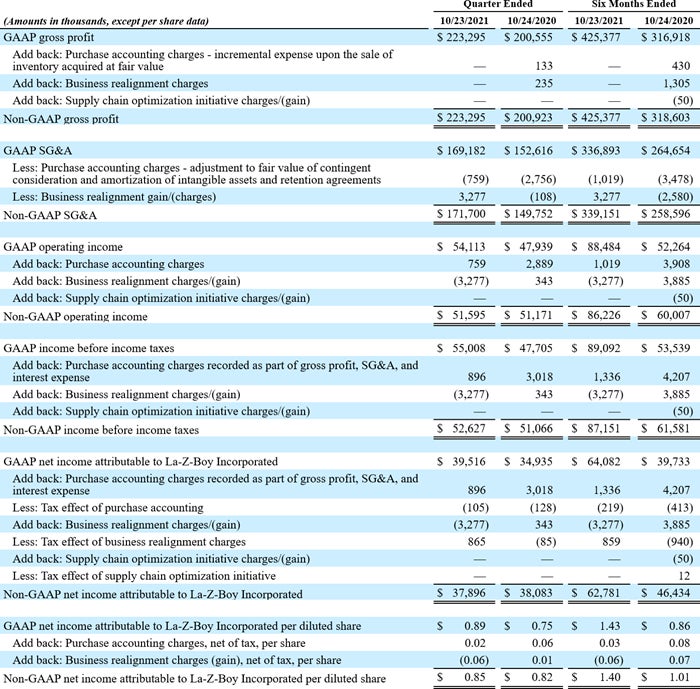

Please refer to the accompanying “Reconciliation of GAAP to Non-GAAP Financial Measures” for detailed information on calculating the Non-GAAP measures used in this press release and a reconciliation to the most directly comparable GAAP measure.

La-Z-Boy will hold a conference call with the investment community on Wednesday, November 17, 2021, at 8:30 a.m. Eastern time. The toll-free dial-in number is 888.506.0062; international callers may use 973.528.0011. Enter Participant Access Code 206517.

The call will be webcast live, with corresponding slides, and archived on the Internet. It will be available at https://lazboy.gcs-web.com/. A telephone replay will be available for a week following the call. This replay will be accessible to callers from the U.S. and Canada at 877.481.4010 and to international callers at 919.882.2331. Enter Replay Passcode: 43533. The webcast replay will be available for one year.

This news release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Generally, forward-looking statements include information concerning expectations, projections or trends relating to our results of operations, financial results, financial condition, strategic initiatives and plans, expenses, dividends, share repurchases, liquidity, use of cash and cash requirements, borrowing capacity, investments, future economic performance, business and industry and the effect of the novel coronavirus (“COVID-19”) pandemic on our business operations and financial results.

The forward-looking statements in this press release are based on certain assumptions and currently available information and are subject to various risks and uncertainties, many of which are unforeseeable and beyond our control, such as the continuing and developing impact of, and uncertainty caused by, the COVID-19 pandemic. Additional risks and uncertainties that we do not presently know about or that we currently consider to be immaterial may also affect our business operations and financial results. Our actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties discussed in our fiscal 2021 Annual Report on Form 10-K and other factors identified in our reports filed with the Securities and Exchange Commission (the "SEC"), available on the SEC's website at www.sec.gov. Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or for any other reason.

This news release is just one part of La-Z-Boy’s financial disclosures and should be read in conjunction with other information filed with the SEC, which is available at: https://lazboy.gcs-web.com/financial-information/sec-filings. Investors and others wishing to be notified of future La-Z-Boy news releases, SEC filings and quarterly investor conference calls may sign up at: https://lazboy.gcs-web.com/.

La-Z-Boy Incorporated is one of the world’s leading residential furniture producers, marketing furniture for every room of the home. The Wholesale segment includes England, La-Z-Boy, American Drew®, Hammary®, and Kincaid®. The company-owned Retail segment includes 159 of the 351 La-Z-Boy Furniture Galleries® stores. Joybird is an e-commerce retailer and manufacturer of upholstered furniture.

The corporation’s branded distribution network is dedicated to selling La-Z-Boy Incorporated products and brands, and includes 351 stand-alone La-Z-Boy Furniture Galleries® stores and 560 independent Comfort Studio® locations, in addition to in-store gallery programs for the company’s Kincaid and England operating units. Additional information is available at http://www.la-z-boy.com/.

In addition to the financial measures prepared in accordance with accounting principles generally accepted in the United States ("GAAP"), this press release also includes Non-GAAP financial measures. Management uses these Non-GAAP financial measures when assessing our ongoing performance. This press release contains references to Non-GAAP operating income, Non-GAAP operating margin, Non-GAAP income before income taxes, Non-GAAP net income attributable to La-Z-Boy Incorporated and Non-GAAP net income attributable to La-Z-Boy Incorporated per diluted share, which may exclude, as applicable, business realignment charges, purchase accounting charges, and charges for our supply chain optimization initiative. The business realignment charges include severance costs, asset impairment costs, and costs to relocate equipment and inventory related to organizational changes we undertook as a result of our response to COVID, including a reduction in the company's work force, temporary closure of certain manufacturing facilities and subsequent gains resulting from the sale of related assets. The purchase accounting charges may include the amortization of intangible assets, incremental expense upon the sale of inventory acquired at fair value, amortization of employee retention agreements, fair value adjustments of future cash payments recorded as interest expense, and adjustments to the fair value of contingent consideration. The charges for our supply chain optimization initiative may include severance costs, accelerated depreciation expense, costs to relocate equipment and inventory, as well as other costs related to the closure, relocation and sale of certain manufacturing operations. In addition, this press release references the Non-GAAP financial measure of “Non-GAAP operating margin” for a future period. Non-GAAP operating margin may exclude items such as pre-tax purchase accounting charges and pre-tax business realignment charges. These and other not presently determinable items could have a material impact on the determination of operating margin on a GAAP basis and due to the probable variability and limited visibility of excluded items, we have not provided a reference to future period GAAP operating margin or a reconciliation of non-GAAP operating margin for future periods in this press release. These Non-GAAP financial measures are not meant to be considered superior to or a substitute for La-Z-Boy Incorporated’s results of operations prepared in accordance with GAAP and may not be comparable to similarly titled measures reported by other companies. Reconciliations of such Non-GAAP financial measures to the most directly comparable GAAP financial measures are set forth in the accompanying tables.

Management believes that presenting certain Non-GAAP financial measures will help investors understand the long-term profitability trends of our business and compare our profitability to prior and future periods and to our peers. Management excludes purchase accounting charges because the amount and timing of such charges are significantly impacted by the timing, size, number and nature of the acquisitions consummated and the success with which we operate the businesses acquired. While the company has a history of acquisition activity, it does not acquire businesses on a predictable cycle, and the impact of purchase accounting charges is unique to each acquisition and can vary significantly from acquisition to acquisition. Similarly, business realignment charges and the charges related to the company's supply chain optimization initiative are dependent on the timing, size, number and nature of the operations being moved or closed, and the charges may not be incurred on a predictable cycle. Management believes that exclusion of these items facilitates more consistent comparisons of the company’s operating results over time. Where applicable, the accompanying “Reconciliation of GAAP to Non-GAAP Financial Measures” tables present the excluded items net of tax calculated using the effective tax rate from operations for the period in which the adjustment is presented, except for the non-tax deductible goodwill impairment charge and the adjustment to the fair value of contingent consideration which reflects the associated GAAP tax impact in the period presented.